Have you ever tried to access your bank account only to be stopped by a confusing error code? These codes can feel like a secret language, leaving you frustrated and unsure of what to do next.

But what if you could quickly understand what each bank error code means and how to fix it? This guide will give you a clear list of common bank error codes, so you can take control of your finances without the guesswork.

Keep reading, and you’ll never be caught off guard by a bank error again.

Common Bank Error Codes

Transaction failures happen due to many reasons. Codes like TXN001 show insufficient funds. TXN002 means card expired. Sometimes, TXN003 signals network issues. These codes help banks and customers understand the problem fast.

Account access issues include problems like locked accounts or wrong passwords. Code ACC101 means account locked for safety. ACC102 shows wrong PIN entered too many times. These alerts protect your money from fraud.

Payment declines occur when payments cannot be processed. Code PAY201 means payment blocked by bank. PAY202 shows incorrect payment details. PAY203 means daily limit reached. Knowing these codes helps fix issues quickly.

Credit: www.scribd.com

Causes Behind Error Codes

Technical glitches happen when bank systems face bugs or crashes. These errors can stop transactions or delay processing. Sometimes, servers go down, causing service interruptions. Banks work to fix these issues fast.

Incorrect information is a common cause of error codes. Wrong account numbers, mismatched names, or expired cards can block payments. Always double-check details before submitting.

Security flags appear if a transaction looks unusual. Banks watch for fraud or hacking attempts. They may freeze accounts or ask for extra verification to protect money. This keeps your funds safe.

How To Decode Error Messages

Numeric error codes are short numbers banks use to show specific problems. Each code stands for a different issue, like insufficient funds or wrong account details. Knowing these codes helps fix problems fast.

Banks often have websites or apps with lists of error codes. These resources explain what each number means. Checking these helps understand the error and what to do next.

Third-party tools can also help decode bank errors. They collect data from many banks and show clear explanations. These tools save time and reduce confusion when facing unknown codes.

Steps To Resolve Banking Errors

Start by calling customer support. Explain the error clearly and calmly. Have your account number ready to speed up the process. The support team will ask you some questions to verify your identity.

Check your account details carefully. Confirm your name, account number, and recent transactions. Mistakes in these details can cause errors. Fix any wrong information with the bank.

Ask the bank to correct the error. They may need some time to investigate and fix the issue. Keep a record of your communication and complaint number for follow-up.

Preventing Future Bank Errors

Regularly checking your bank account helps catch errors fast. Look for strange charges or missing deposits. Set reminders to review your statements weekly or monthly. This habit keeps your money safe and gives peace of mind.

Keep your personal information safe to stop fraud. Never share passwords or PINs with anyone. Use strong, unique passwords for online banking. Avoid public Wi-Fi when accessing your bank account. Small steps protect your money.

Know your bank’s rules and updates. Banks often change fees or policies. Read emails or letters from your bank carefully. Understanding these changes can prevent surprises and errors on your account.

Credit: es.scribd.com

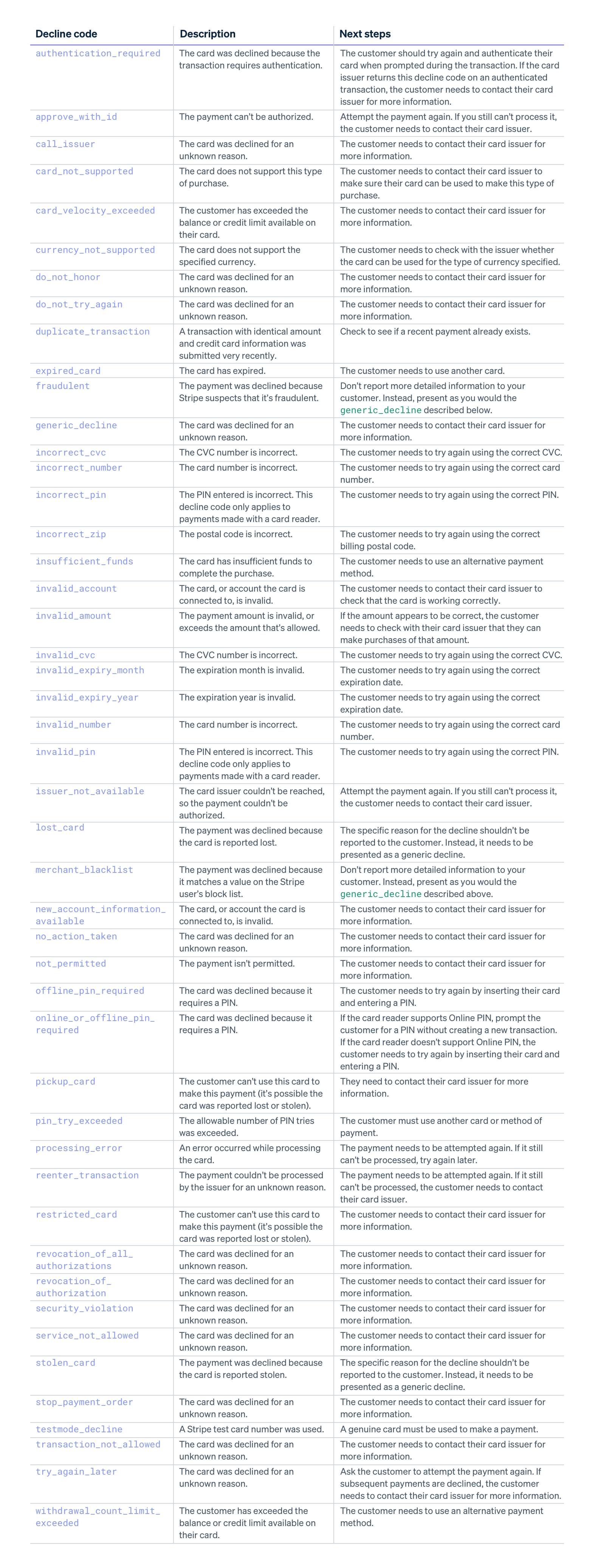

Credit: stripe.com

Frequently Asked Questions

What Are Common Bank Error Codes And Their Meanings?

Bank error codes are short messages showing specific problems in transactions, like “Insufficient Funds” or “Invalid Account. “

How Can I Fix A Bank Error Code On My Account?

Check the error message, contact your bank, and follow their instructions to resolve the issue quickly.

Why Do Bank Error Codes Appear During Transactions?

Errors happen due to wrong info, technical glitches, or security checks during money transfers or payments.

Can Bank Error Codes Affect My Credit Or Account Status?

Most bank error codes do not impact credit but may temporarily block transactions until fixed.

Conclusion

Understanding bank error codes helps you solve problems fast. These codes show specific issues with your transactions or account. Knowing common codes can save time and reduce stress. Always check the code carefully before calling your bank. This way, you explain the problem clearly and get help quicker.

Keep this list handy for future reference. Being informed makes banking easier and safer. Stay aware and handle errors with confidence. Simple steps make a big difference.